With the Global Economies current inflationary worries, the questions is not: If most of the World’s Central Banks are going to hike rates to stave of inflation, but rather When are they going to start?

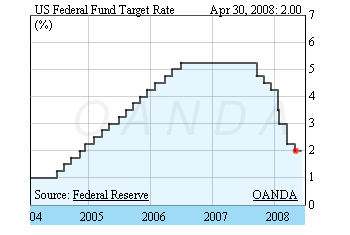

The US Federal Reserve has already strongly hinted that their ease cycle is over. What remains unclear is if the current state of the American Economy is strong enough to start a rate hike cycle. The following graph shows the evolution of the Federal Funds Rate since 2004.

It has been mentioned recently Federal Reserve Funds Rate started to climb from a rate of 1.00% in June 2003 until reaching a high of 5.25% on June 29th 2006. This marked the first meeting of the Federal Open Market Committee (FOMC) under current Chairman Ben Bernanke.The following FOMC meetings significantly lowered the Funds Rate. Current USD weakness has prompted functionaries to move towards a rate hiking scenario, but questions remain if the US is facing more pressure from inflation or from a threat to economic growth which could trigger further economic losses.

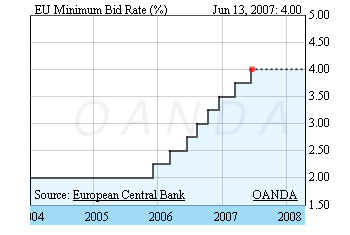

By comparison the European Central Bank helmed by Trichet has inflationary pressures reaching decade high numbers in almost all of the European Union member countries. The Minimum Bid Rate has steadily been hiked since 2006, and Trichet and his team have endured first easing concerns to erode rate diffentials with the US, and now a pressure from the local heads of various european goverments to hike rates and cool down inflation.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.