It was important that you did not close your eyes, otherwise you would have missed that Spanish relief rally. The lack of market conviction has investors believing that another Euro-zone member will eventually be seeking a handout. Despite their government assurance of no, will it be Italy? The market is not so sure that Spain, the EU members fourth largest economy, is capable of going it alone from here on in. The exact amount of emergency funding that Spain will receive will be decided after two audits of its banks are completed within the next few days. So far, the+EUR100b potential sweetener of a “credit line†has not been capable of reducing the borrowing costs for either Italy or Spain. The rise in both countries bond yields is an indication that the market is still worried about the countries’ finances. Spain is in its second recession in three years and the longer their downturn lasts, the harder it will be to repair the banks’ and country’s finances.

Investors should expect confusion, nervousness, and uncertainty to remain key drivers of market price action. Logic or confidence is not apart of the equation ahead of Italian supply this Thursday and this weekends all important Greek election. Italy is expected to auction +4.5b 3’s and 7’s and it will be seen as another litmus test for the periphery bond market. Investors remain disappointed by the lack of action by the EU policy makers and the CBank, as structural issues repeatedly have not been addressed. We can at least be thankful that the slower moving Euro bureaucrats managed to prevent a Spanish banking collapse by adding liquidity this past weekend. However, a temporary solution requires only a temporary relief rally, and this seems to be something we are in the midst of, unless of course an ironclad solution is brought to investors attention soon.

Expect investors to try to keep their powder dry, and preserve capital with the Greek election approaching. Rumors of EU finance officials discussing a worst-case scenario like limiting the size of withdrawals from ATM machines, imposing border checks and introducing capital controls in Greece should Athens decide that they do not want to play with the ‘next door neighbor,’ anymore will add little to the already dented market confidence. Despite core EU markets treading water, speculators are continuing to pressurize periphery equity and bond indices this morning. The rabid price movement of yesterday has abated, so much so that some speculators are willing to play around the market noise and focus on the next assumed weakest link. With the highly anticipated Greek elections approaching, and absent of any core Spanish detail, the market will be expected to punish other peripheral paper and that will be Italy this Thursday. The health of Spanish finances remains under scrutiny. It’s inability to fund its own bank bailout suggest a wider funding problem. It is this that will leave the door ajar for further capital market punishment. However, jaded focus for now has temporarily shifted.

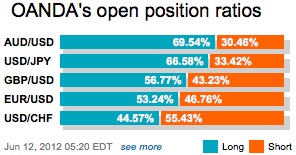

There are a few investors and well seasoned speculators willing to undertake a quick market flip at current levels. Looking at data from the retail sector, they are currently long the market near the recent lows, and seem just as happy as other speculators to own some EUR’s on these dips as long as 1.2385 holds. This level to them is the game changer. Through here, everyone and their mother supposedly flips to a bearish stance looking to replicate 2010s low target of 1.1875. Assuming current levels hold, top side will be capped with strong resistance at 1.2670.

Talk about lack of market vindication, technical analysts are covering all the bases, up and down. Now that price action has filled in the gap from Sunday night and has broken below the 10DMA, a percentage feel comfortable shorting the market again on rallies, rather than chase spot prices lower. They all seem to agree that 1.2435’s is price pivotal and that they are plenty of indicators indicating that the common currency has completed its upside correction. However, until this key support level is broken, then the possibility of price extension remains on the table. The risk reward percentages is looking to play from the long side with a tight stop below this key support, while allowing the topside to run. The more interest appearing at the strong support level will over time only become a more attractive price level for capital markets to trigger!

Other Links:

Optimism for the EUR Unjustified?

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.