European leaders are still in Brussels as part of a two-day meeting to reach agreement on the EU budget. The budget as it stands is one trillion euros. Farm subsidies were passed after being backed by France and Poland. Germany and Britain have formed an alliance after failing to reduce admin costs and pensions. The most likely outcome of the meeting will be an extension as the leaders don’t appear to be close on some matters.

David Cameron and Angela Merkel have both gone on the record saying that no deal will be reached without additional spending cuts back on the table. Merkel was quick to point out that failure to reach an agreement will not have negative consequences as this is the first step and a second round will be needed. Germany, Britain, Sweden and the Netherlands are net budget contributors and as such are pushing for further cuts.

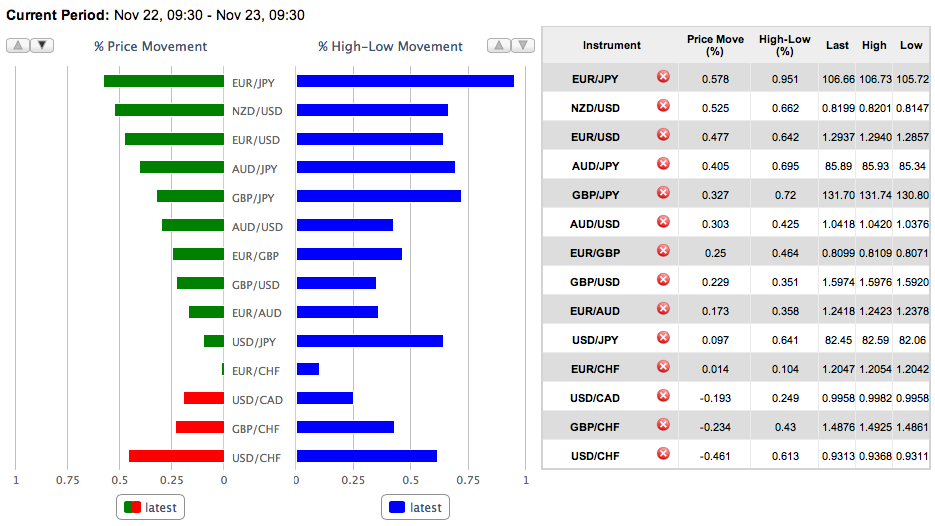

The US entered its Thanksgiving holiday with the news that both US and China manufacturing were expanding again after a long period of contraction. The main beneficiary of that news was the Eur who took advantage of the US holiday to appreciate even as European leaders failed to reach a debt agreement deal on Greece.

Euro zone economic indicators delivered grave news even as the Eur touched weekly highs. Manufacturing continues to contract in Europe with readings very close to those in 2009. Austerity measures will not help boost output which is why the next year outlook is pessimistic for countries such as Greece. German companies are sharing the sentiment as they see the German economy shrinking as well.

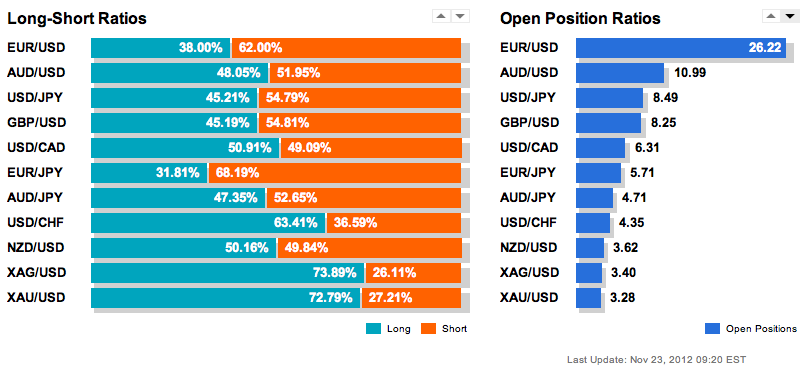

Market sentiment continues to favour EUR/USD trades in aggregate. The long-short ratio begins to skew towards Euro shorts. The split is now 38% long to 62% short for EUR/USD. Metals continue their long bias. EUR/JPY favors Euro strength versus the Yen as the asian country is close to elections and with very disappointing export data.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.